As expected, the Federal Open Market Committee (FOMC) decided to keep the target range for the federal funds rate at 5.25 to 5.50 percent for the fifth consecutive meeting, as it wants to "gain greater confidence that inflation is moving sustainable toward 2 percent" before beginning to cut rates. Two years into the most aggressive tightening cycle since the early 1980s, one thing appears to be clear though: unless something extraordinary happens and inflation unexpectedly heats up again, we have likely reached the ceiling and rates will only go down from here.

As expected, the Federal Open Market Committee (FOMC) decided to keep the target range for the federal funds rate at 5.25 to 5.50 percent for the fifth consecutive meeting, as it wants to "gain greater confidence that inflation is moving sustainable toward 2 percent" before beginning to cut rates. Two years into the most aggressive tightening cycle since the early 1980s, one thing appears to be clear though: unless something extraordinary happens and inflation unexpectedly heats up again, we have likely reached the ceiling and rates will only go down from here.

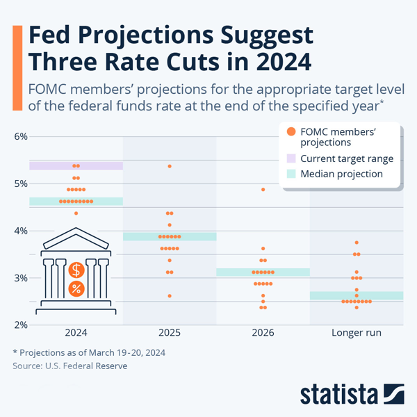

"The economy has made considerable progress toward our dual mandate objectives," Fed chairman Jerome Powell said at a press conference. "Inflation has eased substantially while the labor market has remained strong, and that is very good news." Powell refused to declare 'mission accomplished' just yet, though, pointing out that "inflation is still too high, ongoing progress in bringing it down is not assured, and the path forward is uncertain." He did say that it would "likely be appropriate to begin dialing back policy restraint at some point this year," though, which is about as optimistic as it gets from Powell, who has been very cautious with his rhetoric throughout the inflation crisis. In agreement with their chairman, FOMC meeting participants also reiterated their belief that rate cuts are on the horizon for 2024. According to projection materials published on Wednesday, we could see as many as three 25 basis point cuts before the end of the year, with 15 out of 19 meeting participants anticipating that the target range for the federal funds rate will fall below 5 percent by year's end.

For next year and beyond, the committee members expect interest rates to return to lower levels, albeit at a slower pace than previously anticipated. Looking at the dot plots for 2025 and beyond also reveals a high degree of uncertainty and different levels of optimism within the committee, as predictions for the appropriate policy rate at the end of 2025 range from 2.625 to 5.375 and from 2.375 to 4.875 for the end of 2026.

Have any questions or comments about this information? Request a complimentary consultation, either in-person or virtually, with a Financial Advisor at Elements Wealth Management.

Important Disclosures

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

This article was prepared by FMeX.

LPL Tracking #557161