As a Young Professional, it’s more important than ever to ensure you’re managing your money wisely, both now and in the future. Our team of financial education experts interviewed more than a dozen young professionals to hear their biggest money-related questions and concerns. Now, we’ve assembled the most commonly mentioned topics with our best tips and tricks to help you make the most of your current situation and set you up for success in the future.

Evaluate Your Current Spending & Saving

It’s important to know where you stand now before making a plan or setting goals for the future. Our experts have defined these three questions to help you establish a basis for where you stand with your saving and spending:

- Are you spending more than you're making?

- Do you know where your money is going?

- Have you clearly defined short- and long-term financial goals?

Once you’ve answered these questions, it’s easy to start moving forward by taking these simple steps:

Track Your Spending: Use a pen and paper, a spreadsheet or a resource such as the Elements Budgeting Tool

Design a Financial Strategy: Base your plan on the data from tracking your previous spending and setting new goals

Establish an Emergency Fund: Start with at least $1,000 to ensure you are prepared for unexpected expenses

Manage Your 401(k): Ensure you are getting your employer's full match and consider contributing extra earlier in your career to lead to higher returns later

Understand Your Online Presence

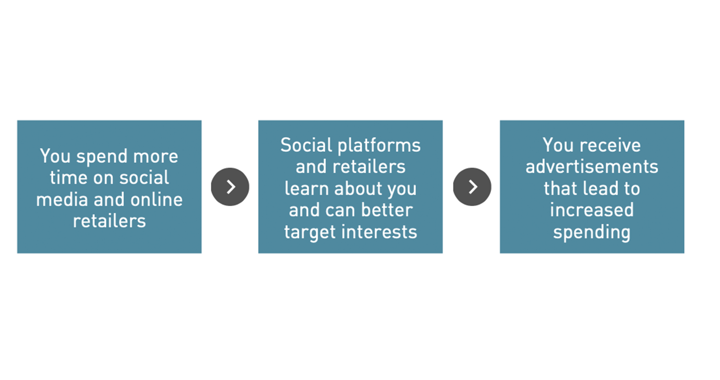

As we spend more time on the internet, social media giants and private companies continue to learn more about us and our spending habits. They use that data to target consumers at times and places that they are most likely to splurge and make a purchase.

How does the process work? This is the typical formula:

Want to avoid spending more online? Consider these tips from our financial experts:

- Consistently clear your web browser’s cache of stored cookies

- Switch to private mode on your phone or computer to lessen the likelihood of being retargeted when shopping

- Add items to your cart but do not check out until the next day

- Take 48 hours to consider your online purchases

- Move money you would have spent on unnecessary online purchases to a savings account

Deal with Your Debt

Whether you’re working to pay it off or just looking to avoid it in the future, debt is something that plays a role in the life of nearly all young professionals. If you’re curious where your current position may be, consider these questions:

- What debt do I currently have and what are my interest rates?

- Do I have extra money each month to pay toward debt?

- Are my spending behaviors leading to more debt?

There are two highly popular debt repayment strategies we talk about with members. Both focus on one major bill at a time, so your debt is easier to manage. They are called “The Snowball” and “The Avalanche” and you can explore each method to determine which you prefer for your own debt repayment plan. We recommend you begin by listing in a chart all your debts and including the creditors you owe, your minimum payments, your overall balances, and your interest rates.

The Debt Snowball: With this method, you focus on eliminating the smallest balance you owe first, while also making minimum payments on all your other debts. By focusing on a smaller debt, you will see success sooner when you remove an entire line item from your chart, and it will mentally motivate you to knock out other progressively larger balances the same way.

The Debt Avalanche: This method tackles your highest interest rate first, regardless of balance, then progresses to your lowest interest rate. This can save you some money in the long run because you’ve eliminated your higher priced debt first your lesser interest rates will be okay sitting for longer.

Manage Your Mortgage

Buying a home is often a goal for young professionals and Elements is here to support you with trusted advice, considering this is typically one of the largest purchases that you’ll make in your lifetime.

Where do I even start? Consider these items as a starting point:

- Understand the multiple types of mortgage products and which works best for your situation

- Work to improve your credit score to attain the best rate

- Meet with a Mortgage Loan Originator to get pre-approved before looking for homes with a Realtor

What does my credit have to do with my mortgage? Your score plays a large factor in a lender's decision and the terms:

- Your credit score is a way to track how you manage money over time, with data coming from creditors, public records, and debt collection agencies

- This score is reported by three major credit bureaus and scores can range from 300 to 850

- By increasing your score, you may qualify for a lower interest rate, saving you money throughout the term of the loan

Elements is able to offer competitive loan rates and unique products as a credit union. We have a team of more than a dozen Mortgage Loan Originators who are experienced with all types of loans and are here to lead you along the way.

Set Yourself Up for Future Success

Investing is often just an expansion of your savings strategy and has the potential to earn much higher returns than a typical savings account or certificate.

At Elements, we recommend that you meet with a qualified Financial Advisor to guide you through the investing process. You may want to ask them some initial questions when you meet for the first time including:

- How are you compensated for managing my investments?

- Do you specialize in specific types of clients?

- What is the average size of portfolio you work with?

- How often would you evaluate my finances and provide me an update?

- How often will we talk?

- What's your personal investment philosophy?

Have questions or need trusted advice? Our credit union experts are always here for you. Contact Elements Financial for support in all aspects of your financial life.

This information is provided for informational purposes only. It does not constitute legal, tax or financial advice. Consult with your tax, legal or financial adviser before taking any action.