So, what exactly is a Health Savings Account (HSA)?

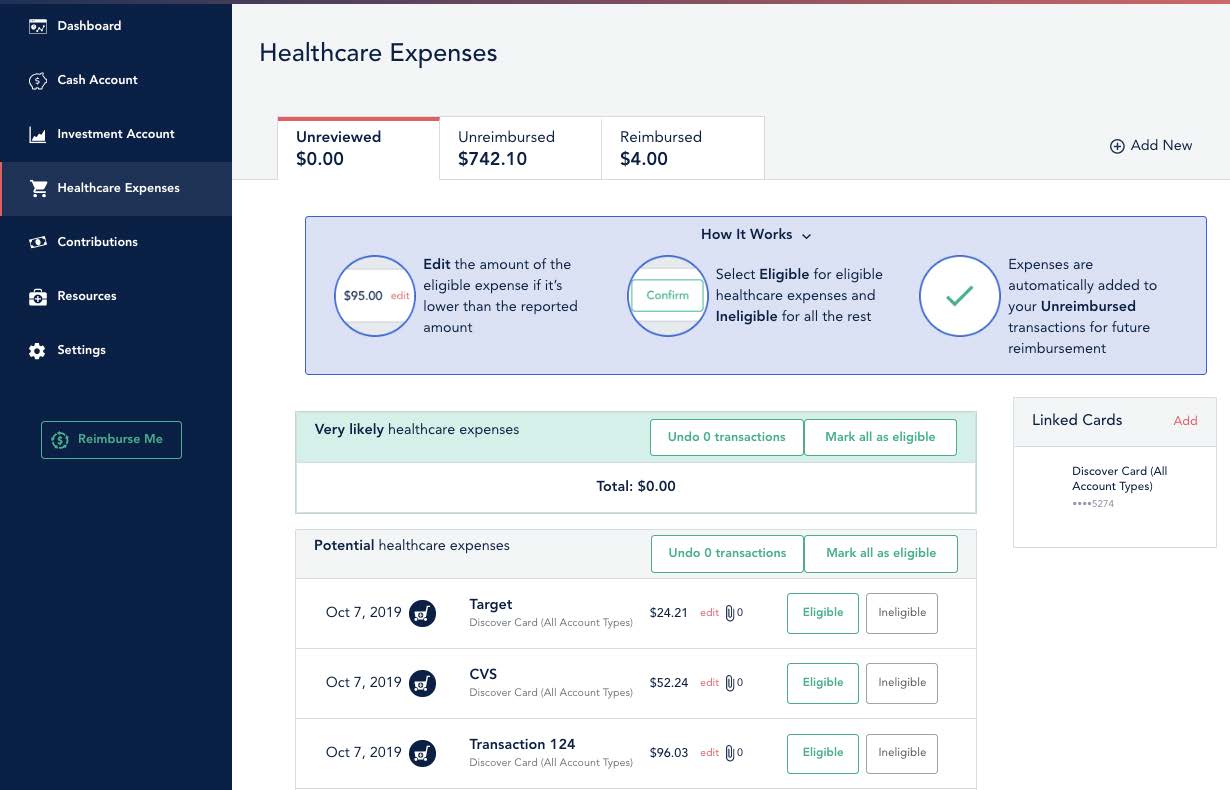

A Health Savings Account (HSA) is a tax-advantaged medical savings account available to taxpayers in the United States who are enrolled in a high-deductible health plan (HDHP). An HSA allows you to pay for current health expenses and save for future medical and retiree healthcare expenses on a tax-free basis. Contributions, earnings, and distributions are all exempt from federal income taxes when funds are used for qualified medical expenses.

You can use the HSA to cover expenses related to your High Deductible Health Plan until you meet your deductible. After your deductible has been met, your health plan coverage will then pay all or a portion of your medical costs, depending on the benefit design of the health plan. Any excess funds available in the HSA may be used for other qualified expenses, including dental and vision costs. Funds may also remain in the HSA to grow for use in future years.