How does the Butler University Rewards Visa compare to other credit card options?

The main difference is that you show your Butler pride every time you use the card. Go Dawgs! You also earn rewards with use.

Covering up to $100,000 Covering up to $250,000 Covering up to $250,000 Covering up to $100,000

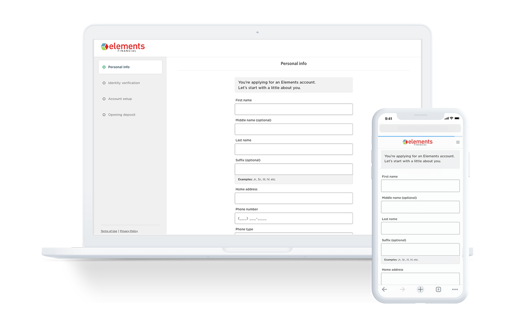

Butler University Rewards Visa

Elements Signature Rewards Visa

Indianapolis Indians Signature Rewards Visa

Elements Platinum Visa

Apply Now

Apply Now

Apply Now

Apply Now

Key Benefit

Earn rewards and show your Butler pride!

Earn rewards for purchases, e.g. travel and gift cards

Pay with pride and support the Indianapolis Indians, plus earn rewards for purchases

Pay off your balance sooner with a low rate

Intro APR for Purchases & Balance Transfers

0% Intro APR for 18 Months on Purchases & Balance Transfers4

0% Intro APR for 18 Months on Purchases & Balance Transfers4

0% Intro APR for 18 Months on Purchases & Balance Transfers4

0% Intro APR for 18 Months on Purchases & Balance Transfers4

Variable APR After Intro Period

17.24%2 variable APR after 18-month Intro Period

15.24%5 variable APR after 18-month Intro Period

15.24%6 variable APR after 18-month Intro Period

13.24%7 variable APR after 18-month Intro Period

Rewards

Earn 1% cash back on every eligible purchase with Pure Perks1

Features Pure Perks Rewards where you can earn 1.50 points to the dollar with every purchase.8

Features many special perks for you to enjoy at Victory Field and our Pure Perks Rewards program where you can earn 1.50 points to the dollar with every purchase.9

—

Balance Transfer Fee

4%3

4%10

4%11

4%12

No Annual Fee

Special Feature

No international transaction fee

No international transaction fee

No international transaction fee plus $100 Donation to support the Indianapolis Indians Charities13

No late payment fee

Auto Rental Collision Damage Waiver

Cardholder Inquiry Service

Emergency Card Replacement

Lost or Stolen Card Reporting

Purchase Security

Zero Liability Policy

Roadside Dispatch

Travel & Emergency Assistance Services

Travel Accident Insurance

Lost Luggage Replacement

—

—

Extended Warranty Protection

—

—

Year-end Summary Statement

—

—

Apply Now

Apply Now

Apply Now

Apply Now