Chip Cards

Get big protection in a tiny chip. Elements credit cards have chip technology built right in. This tiny chip will protect your card's information in a big way. When you use your chip card at a chip-enabled terminal, the embedded chip generates a unique transaction code. This helps prevent stolen data from being fraudulently used. Plus, you're protected against unauthorized use with Visa's Zero Liability Fraud Protection.

Fraud Alerts

We offer near real-time fraud alerts for all Elements credit cards. With a quick text alert, you can help prevent fraudulent transactions from occurring on your cards. The service is free, and your card is automatically enrolled! How it works:

- A text message will be sent to your mobile device when there is a suspicious transaction identified on your account.

- Simply reply to confirm whether or not you recognize the transaction(s).

- If you let us know that you do not recognize the transaction(s), we will block usage of your card until we hear from you.

- If you reply that you recognize the transaction(s), your card will remain available for use.

- If we don’t receive a response from you for the text message, we will reach out to you through email and phone to verify the suspicious transaction.

- If you would like to opt out of this service, just reply STOP to the text alert, or call us at 800-621-2105.

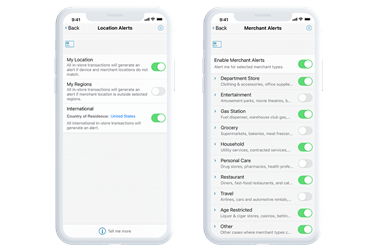

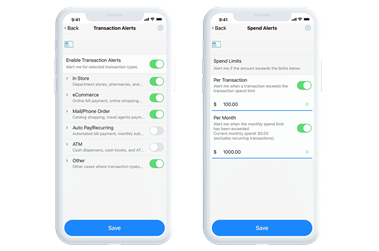

Transaction Alerts with Card Control

Card Control is a companion app to our Online Banking app that allows you to control when, where, and how your Elements credit and debit cards are used. Instantly turn them off and on, set controls on usage, and establish alerts for a variety of card activities. Learn more about Card Control.

Online Shopping Secured with Visa

Visa has developed a program that helps confirm your identity when you make an online purchase. This service helps make shopping online more secure by protecting against unauthorized use of your Visa card. There’s no need to download anything, install software or register. During an online purchase from your desktop, mobile or other digital device, you may be guided through an extra check to verify your identity. This helps Elements know you’re really you and most importantly it protects you from fraud.