Better rates and fewer fees than the average bank or credit union.

Or call 1-800-621-2105

Apply Now

Or call

1-800-621-2105

Learn More about our Auto Loans

Open an Account

Or call

1-800-621-2105

Compare our Savings Accounts

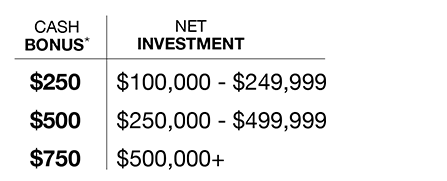

From paying for your next vacation to supporting home improvements, a $750 cash bonus from Elements Financial* is a great way to cover something extra — just for you.

From paying for your next vacation to supporting home improvements, a $750 cash bonus from Elements Financial* is a great way to cover something extra — just for you.

Have we piqued your interest? Learn more about our program offering up to a $750 Cash Bonus for your investment at a free consultation.

Request a Free Consultation

Or call

1-888-425-0374

*Wealth Management Related $750 Cash Bonus Offer — Must keep funds invested for six months to receive bonus payout; bonus paid at that time. Bonus will be paid by Elements Financial to a separate non-investment account. Moving funds from another investment firm may be subject to a fee that neither Elements Financial nor Elements Wealth Management will reimburse. Elements Financial reserves the right to amend or discontinue offer at any time. Additional terms and conditions may apply. Bonus may be subject to taxes; please contact your tax advisor.

Elements Financial Federal Credit Union (“Financial Institution”) provides referrals to financial professionals of LPL Financial LLC (“LPL”) pursuant to an agreement that allows LPL to pay the Financial Institution for these referrals. This creates an incentive for the Financial Institution to make these referrals, resulting in a conflict of interest. The Financial Institution is not a current client of LPL for brokerage or advisory services. Please visit https://www.lpl.com/disclosures/is-lpl-relationship-disclosure.html for more detailed information.

Securities and advisory services are offered through LPL Financial (LPL), a registered investment advisor and broker/dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. Elements Financial Federal Credit Union and Elements Wealth Management are not registered as a broker/dealer or investment advisor. Registered representatives of LPL offer products and services using the name Elements Wealth Management and may also be employees of Elements Financial Federal Credit Union. These products and services are being offered through LPL or its affiliates, which are separate entities from and not affiliates of Elements Financial Federal Credit Union or Elements Wealth Management. Securities and insurance offered through LPL or its affiliates are: