From influencing your interest rates to deciding if you’ll qualify for a mortgage or auto loan, your credit score is one of the most impactful numbers in your life. While an estimated 55% of Americans never check their credit scores, knowing and understanding your score is the only way to maintain or improve it. The good news? Elements Financial has a tool designed to help you better understand, manage, and improve that score.

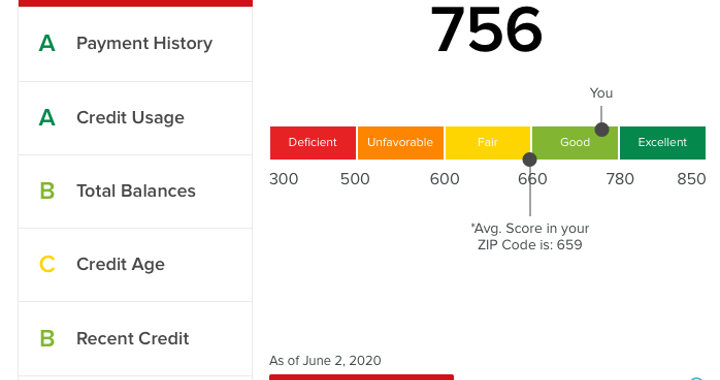

SavvyMoney is available to all Elements members in both online and mobile banking. Your SavvyMoney score, ranging from 300-850, tells lenders how likely you are to repay your bills and impacts the rates that you’re charged. Want to learn more about your credit score? Explore our Take Control of Your Credit Advice article.

Our experts are here to walk you through some of SavvyMoney’s key features:

Credit Score & Full Credit Report

Your SavvyMoney score is calculated with five key factors that tell lenders the risk of lending to you:

- Payment History

- Credit Utilization

- Length of History

- Inquiries

- Types of Credit

When you use our SavvyMoney tool, you’ll see your credit score along with a letter grade rating of how well you are performing in each of the five areas. When you expand each section, SavvyMoney will give you further details and action items to help you improve your grade.

Expert Tip: Many people believe that simply checking your credit score will make it decrease. This is far from the truth, as soft inquiries such as checking your score on SavvyMoney have no impact.

Credit Monitoring

While credit scores can seem daunting, regularly monitoring your credit truly pays off in the long run. Your credit is one of your most valuable assets, and staying on top of it is easy with Credit Monitoring built into your SavvyMoney. You’ll receive real-time alerts whenever your score is impacted, such as when you open a new account, receive inquiries, or update your payment history.

SavvyMoney keeps all your accounts in one convenient place and monitors your credit report daily, providing timely updates on your on-time and missed payments.

Expert Tip: If you are struggling to pay all of your bills, ensure that you make payments on anything that reports to your credit first. This will keep your credit score intact, so you’re more likely to be approved for loans in the future.

It’s important to know your score and work to improve it. Even increasing your score by a few points can make a large impact on the rates you receive when seeking a new loan.

Useful Financial Resources

SavvyMoney is packed full of other useful resources that leave zero impact on your score, such as:

Score Simulator: It’s easy to make smart financial decisions when you have all the information you need. This educational tool helps you understand how different factors affect your credit score.

Financial Check-up: Take a short assessment to get your Financial Wellness Score and get insights on how to improve your financial health.

Credit Score Goals: Receive personalized action plans to help you reach your credit goals.

Personalized Product Recommendations: From credit cards to auto loans, SavvyMoney can help you find the best rates and options for refinancing your loans to save money.

Your Money Blog: Review articles that cover topics from spending to debt to fraud in the “Your Money Blog” within the SavvyMoney site.

Ready to get started? Log into your Elements Online Banking account and answer a few first-time user questions. Then, you’ll unlock the full SavvyMoney site to begin your journey to better understanding and managing your credit.

This information is provided for informational purposes only. It does not constitute legal, tax or financial advice. Consult with your tax, legal or financial advisor before taking any action.