In the words of Mike, "I knew exactly what to do, but in a much more real sense I had no idea what to do." We hope that you're not in the same boat as him! If you've made your way to this page, you've likely recently attended our Money with Michael workshop at your workplace or online. At Elements, we focus on financial education, so we are here with additional resources, statistics and downloads to expand on the topics covered in this workshop.

Budgeting and Credit Cards

The best way to begin building your budget is tracking your purchases. Categorize items in your checking account and credit card history from the previous month and or keep your receipts for everything you spend during a 2-week timeframe. Make sure that you pick a "normal" month when reviewing your spending. It’s easy to organize your expenses into these three categories:

- FIXED amounts do not change monthly

- VARIABLE amounts typically do change monthly

- PERIODIC quarterly, semi-annual, and annual payments

Overall, budgeting might be a sacrifice in the short-term, but it will lead you to more successful financial habits in the future.

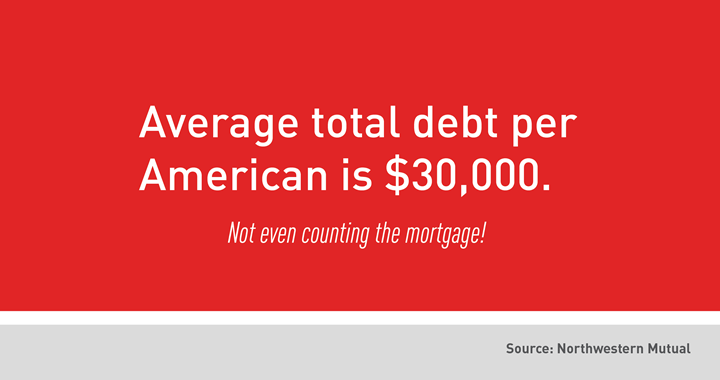

Managing Debt

There are two highly popular debt repayment strategies we talk about with members. Both focus on one major bill at a time, so your debt is easier to manage.

The Debt Snowball: Start Small

With this method, you focus on eliminating the smallest balance you owe first, while also making minimum payments on all your other debts. By focusing on a smaller debt, you will see success sooner when you remove an entire line item from your chart, and it will mentally motivate you to knock out other progressively larger balances the same way.

The Debt Avalanche: Start High

This method tackles your highest interest rate first, regardless of balance, then progresses to your lowest interest rate. This can save you some money in the long run because you’ve eliminated your higher priced debt first your lesser interest rates will be okay sitting for longer.

Investing in Your Future

Whether you’re getting started or you’re a seasoned investor, Elements Wealth Management has the tools to assist you on your journey. There are no account minimums, so this division is here to support all levels of investors. Elements Wealth Management's purpose is to build lifelong relationships, which impact our client’s financial success.

Mortgages and Refinances

Before finding your dream home or visiting an open house, it’s important to begin by analyzing your financial situation. No one likes to be disappointed when they find the perfect home, but it’s out of their price range. Start the process by completing a mortgage application which helps your lender learn more about you and your assets and what you can afford.

After submitting your application, your lender can offer you a pre-approval document. This will tell you the maximum amount they will offer you via a loan for your home. After receiving the pre-approval, you'll need to consider multiple types of loans and shop for your house. Finding the right home and the right loan is the most important and time-consuming part of the process! Once you have found your home, you’ll make an offer and then work with the seller to settle on a mutually agreeable price.

After your offer is accepted, an appraisal, title work, and flood certification will be ordered. Once these services are completed, an underwriter will clear you to close on your new home.

Digital Tools

Gone are the days of having to visit a physical branch location to complete all of your banking transactions. As technology continues to improve, so does the user experience for consumers looking to handle their banking via the internet. According to the US Federal Reserve, online banking is used by 71% of consumers and mobile banking by 38%. Elements is here to enhance your banking experience, including with best-in-class online and mobile banking services. Our eCommerce team is dedicated to continually updating our digital platforms, so watch our website for news of updates that will make banking better for you.

Why Elements? Here's a few of our favorite features from our mobile app:

- Check your balances, make loan payments, and transfer money between accounts

- Pay your bills online 24/7/365 from anywhere

- Pay friends and family conveniently with Zelle®

- Have on-the-go access with the Elements Mobile app for Android and Apple devices